Search

Governor Newsom’s Proposed January 2023-2024 Budget Key Investments Brief for UWCA Members

January 13, 2023

Governor Newsom’s Proposed January 2023-2024 Budget

Key Investments Brief for UWCA Members

Statement from Pete Manzo, President & CEO, UWCA

Californians deserve a state budget that reflects the realities families deal with on a daily basis – rising prices at the grocery store, at the gas pump, the high costs of rent, childcare, school supplies, and more. Governor Newsom’s 2023-24 budget proposal includes many priorities we share, such as ensuring people experiencing homelessness are moved into housing through programs like the Homeless, Housing, Assistance and Prevention program (HHAP), and continuing the expansion of Medi-Cal to all regardless of immigration status.

We applaud these effective investments while also noting a number of key priorities we hope to see included in the budget the Governor and the Legislature negotiate over the coming months leading up to the June budget deadlines:

-

-

- Establish a minimum value for the California Earned Income Tax Credit (CalEITC) of at least $300;

- Expand the Young Child Tax Credit to all CalEITC-eligible families; and

- Invest $20 million in 211 information and referral services as a trusted statewide resource to help more households access programs like CalFresh, Medi-Cal, and navigate disasters like floods and fires.

-

It is always the right time to build a more inclusive economy. The California United Way network will be active throughout the 2023 budget process to protect the progress we have made together. We will ensure that Health, Education, and Financial Stability support for low-income families are top priorities and that the voices of our communities are centered as the budget negotiations are underway.

Executive Summary

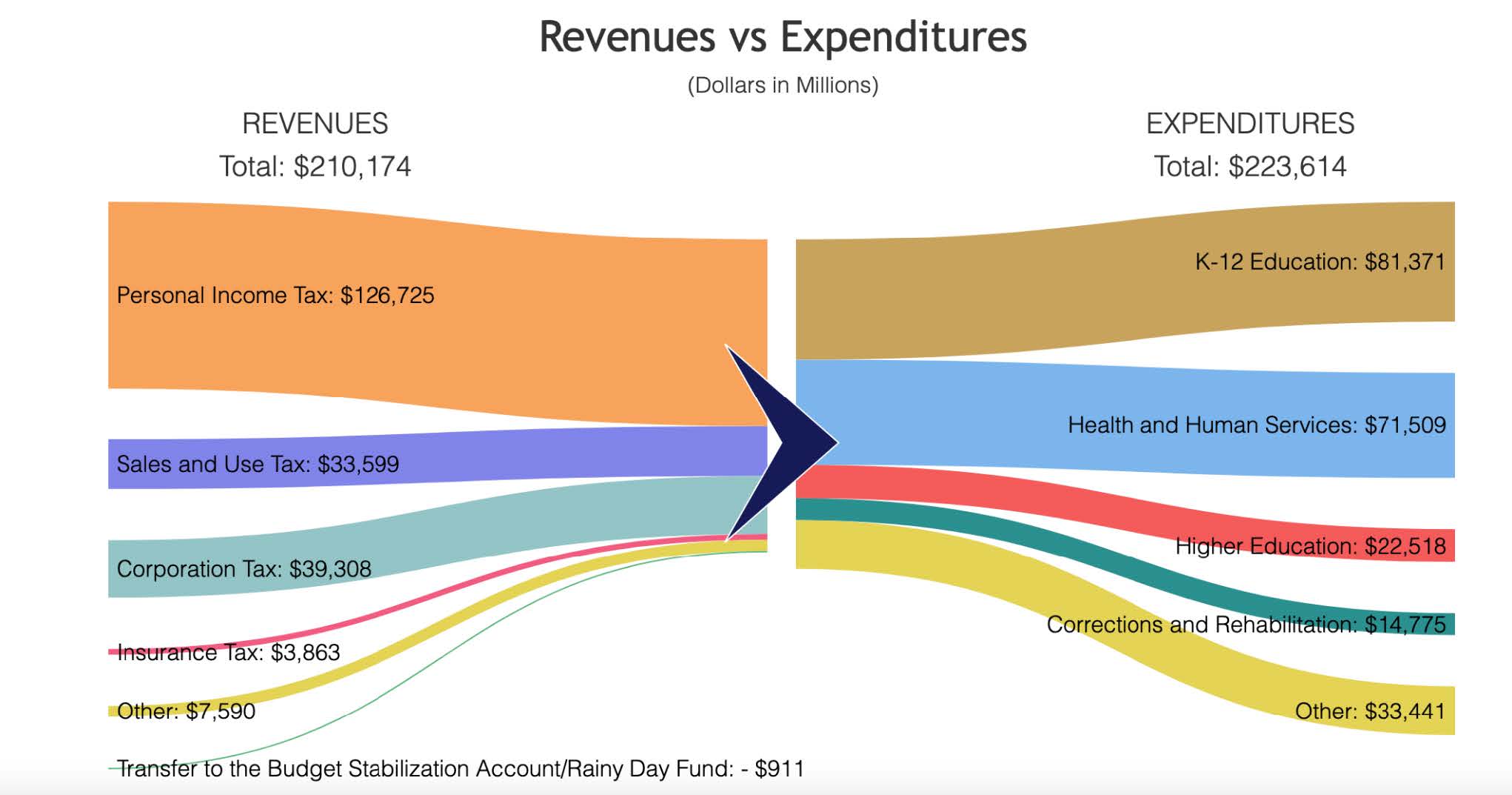

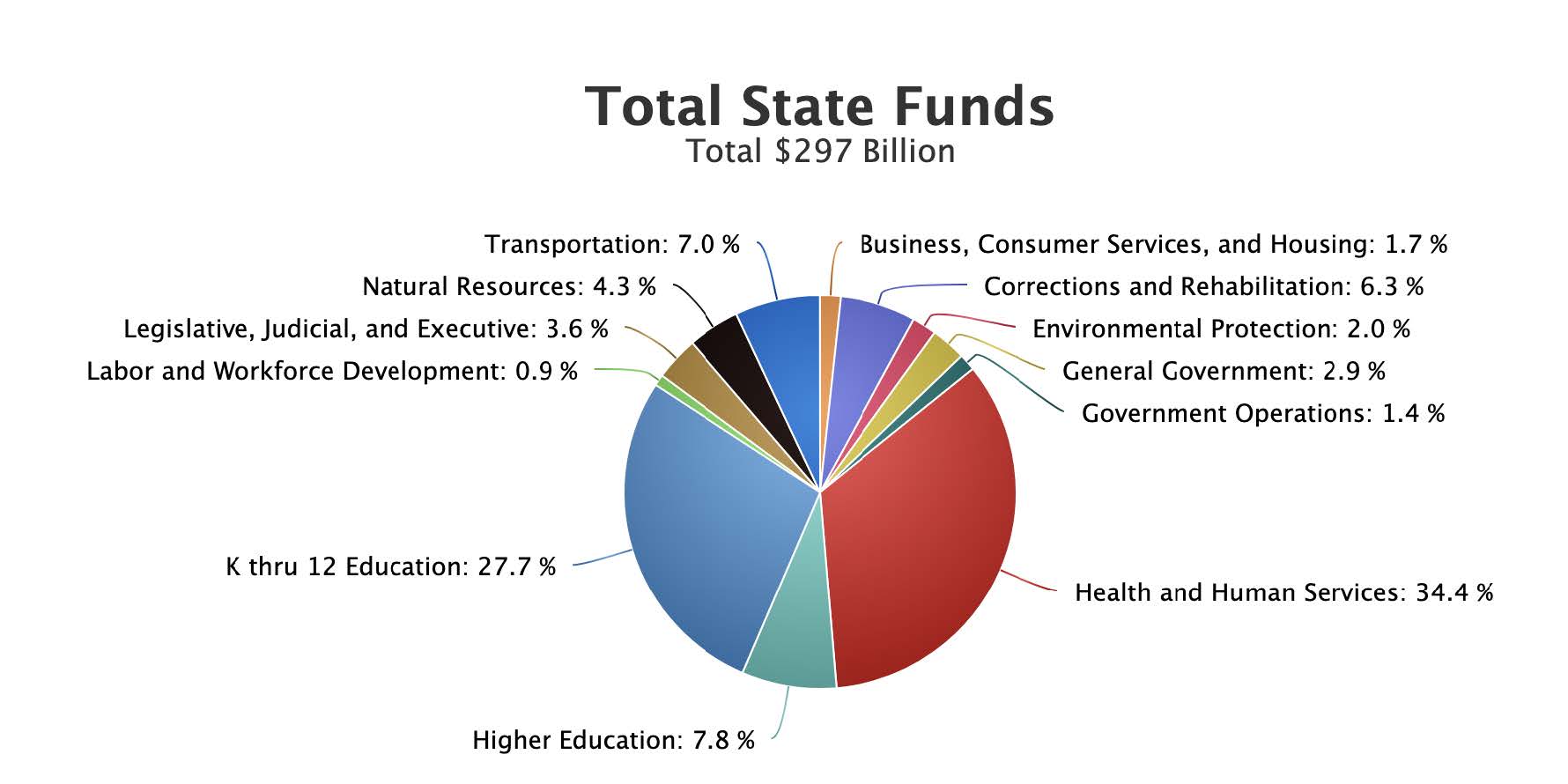

On January 10, 2023, Governor Newsom unveiled his 2023-2024 proposed budget, outlining his Administration’s priorities for the $297 billion budget. Overall, the potential budget allocations for California’s future look much different than in previous years. California now faces an estimated budget shortfall of $22.5 billion in the 2023-24 fiscal year. However, because of planning and budget resilience built into previous years, the state is in a good position to weather this deficit.

This proposed budget is just the first step toward the final 2023-2034 budget for the state. The Legislature has until June to negotiate and approve the final budget before the Governor signs it into law by June 30th, 2023.”

California is currently projected to have a $22.5 billion shortfall Governor’s plan addresses this through the following mechanisms:

-

-

- Funding Delays: $7.4 billion – The budget delays funding for several items and spreads it across multiple years without reducing the total amount. (Funding delays will be noted as [DELAYED] in the summary below)

- Reductions: $5.7 billion – The budget reduces spending for various items included in the 2022 Budget Act. (Reductions will be noted as [REDUCTION] in the summary below)

- Fund Shifts: $4.3 billion – The budget shifts certain projects for 2022-23 and 2023-24 by reverting certain projects from capital outlay to bonds.

- Trigger Reductions: $3.9 billion – The budget reduces funding for certain items and places them in a “trigger” that would restore funding in the 2024 Budget if there are sufficient funds.

- Limited Revenue Generation & Borrowing: $1.2 billion – These funds are derived from loans from special funds and renewal of the Managed Care Organization Tax.

-

Despite falling revenues, the Governor includes key investments in many of UWCA’s priorities (additional funding will be noted as [INVESTMENT] in the summary below) in:

-

-

- Community Schools: $4.1 billion – Enables family and community engagement in the provision of a wide range of academic, health, and social services that support students’ learning.

- Literacy: The Budget includes an additional $250 million to build upon the existing Literacy Coaches and Reading Specialists Grant Program.

- Homeless, Housing, Assistance and Prevention (HHAP): $1 billion- Building on previous investments, this budget invests in the state’s fifth round of HHAP funding which focuses on serving unhoused populations with the highest needs.”

- California Racial Equity Commission: The Budget includes $3.8 million in 2023-24, and $3.1 million through 2028-29 in the General Fund to support the state’s first Racial Equity Commission established by Executive Order last year.

- Medi-Cal Healthcare Acess: The Budget maintains continued funding to expand full-scope Medi-Cal eligibility to all income-eligible Californians, regardless of immigration status. Additionally, the Budget sustains $10 billion in total funds to continue transforming the state’s health care delivery system through California Advancing and innovating Medi-Cal.

- California’s Behavioral Health Community-Based Continuum Demonstration — $6.1 billion over five years to expand behavioral health services and strengthen the continuum of mental health services for Medi-Cal beneficiaries living with serious mental illness and serious emotional disturbance, with a focus on children and youth, individuals experiencing or at risk of homelessness, and justice-involved individuals.

-

General Overview

-

-

- Economic Outlook: The Budget revenue forecast is based on a scenario that assumes continued but slowing economic growth and does not assume a recession. Several risk factors could negatively impact the economy and lead to a recession, which could either be mild or more severe.

-

Even in a moderate recession, revenue declines below the Budget forecast could be significant. The magnitude of the revenue loss would depend upon the depth and duration of a recession, as well as its relative impact on higher-income individuals. A mild recession could lead to General Fund revenue losses between $20 billion to $40 billion relative to the Budget forecast over the budget window. In a moderate to more severe recession scenario, General Fund revenue losses could exceed $60 billion compared to the Budget forecast through 2023-24, based on the revenue declines seen following the 2001 and 2008 recessions.

Policy Area Investments

Education

The Budget includes total funding of $128.5 billion for all K-12 education programs. K-12 per-pupil funding totals $17,519 Proposition 98 General Fund—its highest level ever—and $23,723 per pupil when accounting for all funding sources.

-

-

- Proposition 98 – The Budget includes total funding of $108 billion for Prop 98 which serves all K-14 education programs. This represents a decrease of approximately $1.5 billion relative to the 2022 Budget Act. [REDUCTION]

- Early Childhood Education

- Transitional Kindergarten: The Budget revises estimates for the first-year investment from $614 million to approximately $604 million to expand access to all children turning five years old. [REDUCTION]

- Facilities Grant Program: The Budget delays the 2023-24 planned $550 million Program investment to 2024-25. [DELAYED]

- Literacy: The Budget includes an additional $250 million one-time Proposition 98 General Fund to build upon the existing Literacy Coaches and Reading Specialists Grant Program. [INVESTMENT]

- K-12

- Local Control Funding Formula: The Budget includes an LCFF cost-of-living adjustment of 8.13%, the highest cost-of-living adjustment in recent memory. When combined with growth adjustments, this increase will result in $4.2 billion in additional discretionary funds for schools. [INVESTMENT]

- Arts & Cultural Enrichment: Beginning in 2023-24, the Arts and Music in Schools—Funding Guarantee and Accountability Act (approved by voters in November 2022 as Proposition 28), requires an amount equal to one percent of the Proposition 98 Guarantee to be allocated to schools to increase arts instruction and/or arts programs in public education. As a result, the Budget includes approximately $941 million to fund Proposition 28. [INVESTMENT]

- School Facility Program—A decrease of $100 million General Fund in planned support for the School Facility Program, taking the planned allocation in 2023-24 from approximately $2.1 billion to approximately $2.0 billion. [REDUCTION]

- Reversing Opioid Overdoses—An increase of $3.5 million ongoing Proposition 98 General Fund for all middle and high school sites to maintain at least two doses of naloxone hydrochloride or another medication to reverse an opioid overdose on campus for emergency aid. [INVESTMENT]

- Higher Education: The Budget proposes total funding of $40.3 billion for the three higher education segments and the California Student Aid Commission.

- University of California:

- Base Growth—An increase of approximately $215.5 million ongoing General Fund for operating costs, representing a five-percent base increase in ongoing General Fund resources. This will also support one-percent growth in undergraduate enrollment. [INVESTMENT]

- California State University:

- Base Growth—An increase of $227.3 million ongoing General Fund to support a 5-percent base increase as part of the second year of the multi-year compact agreement for CSU’s continuing commitment towards student access, equity, and affordability, and creating pathways to high-demand career pathways. [INVESTMENT]

- California Community Colleges:

- CCC Apportionments—An increase of $652.6 million ongoing Proposition 98 General Fund to provide an 8.13-percent cost-of-living adjustment (COLA) for Student Centered Funding Formula apportionments and $28.8 million ongoing Proposition 98 General Fund for 0.5-percent enrollment growth. [INVESTMENT]

- Student Enrollment and Retention—An increase of $200 million one-time Proposition 98 General Fund to continue to support community college efforts and focused strategies to increase student retention rates and enrollment, building on an investment of $150 million one-time Proposition 98 General Fund and $120 million one-time Proposition 98 General Fund for student enrollment and retention in the 2022 and 2021 Budget Acts, respectively. [INVESTMENT]

- University of California:

- Early Childhood Education

- Proposition 98 – The Budget includes total funding of $108 billion for Prop 98 which serves all K-14 education programs. This represents a decrease of approximately $1.5 billion relative to the 2022 Budget Act. [REDUCTION]

-

Financial Stability

-

-

-

- Workforce:

- Employment Development Department:$198 million one-time in 2023-24 to continue the planning and development of EDDNext, for the second year of a five-year plan to modernize EDD. [INVESTMENT]

- Unemployment Insurance Debt Payment—The 2022 Budget Act included $1billion to pay down a portion of the state’s approximately $18 billion Unemployment Insurance Trust Fund debt. The Budget proposes to withdraw the $750 million one-time General Fund payment in 2023-24. [REDUCTION]

- Unemployment Insurance Small Business Relief—The Budget proposes to remove the $500 million one-time General Fund commitment made as part of the 2022 Budget Act to offset the anticipated rising federal unemployment insurance tax rates resulting from the Unemployment Insurance Trust Fund insolvency. [REDUCTION]

- Tax Credits:

- Although the initial budget summary does not include any specific mention of tax credits at this time, upon guidance from budget experts we have consulted we assume that there are no new investments or reductions to investments (to the CalEITC, YCTC, etc.) made in previous Budget agreements. We will be sure to provide updates once more information is available.

- Workforce:

-

-

Health & Human Services

The Governor’s Budget includes $230.5 billion for all health and human services programs in 2023-24.

-

-

-

- Department of Healthcare Services

- California’s Behavioral Health Community-Based Continuum Demonstration — The Budget includes $6.1 billion ($314 million General Fund, $175 million Mental Health Services Fund, $2.1 billion Medi-Cal County Behavioral Health Fund, and $3.5 billion federal funds) over five years for the Department of Health Care Services and the Department of Social Services to implement the Behavioral Health Community-Based Continuum Demonstration, effective January 1, 2024. A critical part of CalAIM, the Demonstration includes statewide and county opt-in components to expand behavioral health services and strengthen the continuum of mental health services for Medi-Cal beneficiaries living with serious mental illness and serious emotional disturbance, with a focus on children and youth, individuals experiencing or at risk of homelessness, and justice-involved individuals. The Demonstration will improve integration of medical, behavioral health and social services for foster children and youth, strengthen community-based services, clarify coverage for evidence-based therapies and home-based services for children and families, add critical treatment and supports, and build statewide centers of excellence to support practice transformations. [INVESTMENT]

- Managed Care Organization Tax— A renewal of the Managed Care Organization (MCO) Tax effective January 1, 2024, through December 31, 2026, to help maintain Medi-Cal program funding for the Medi-Cal expansion to all income eligible individuals and minimize the need for reductions to the program. [INVESTMENT]

- Designated State Health Program and Rate Increases— Total General Fund savings of $646.4 million, from the anticipated federal reauthorization of Designated State Health Program funding to cover the costs of the Providing Access and Transforming Health and CalAIM Justice Initiative. Budget also includes $22.7 million in 2023-24 and $57.1 million ongoing for primary care and obstetric care provider increases. [INVESTMENT]

- Reproductive Health Services 1115 Waiver— $200 million in 2024-25 for a grant program through an 1115 federal demonstration waiver focused on supporting access to family planning and related services, system transformation, capacity, and sustainability of California’s safety net. [INVESTMENT]

- CalAIM Transitional Rent Waiver Amendment— $17.9 million in 2025-26 increasing to $116.6 million at full implementation to allow up to six months of rent or temporary housing to eligible individuals experiencing homelessness or at risk of homelessness and transitioning out of institutional levels of care, a correctional facility, or the foster care system and who are at risk of inpatient hospitalization or emergency department visits. [INVESTMENT]

- Community Assistance, Recovery & Empowerment (CARE) Act— $16.5 million General Fund in 2023-24, $66.5 million General Fund in 2024-25, $108.5 million in 2025-26 and annually thereafter to support estimated county behavioral health department costs for the CARE Act. [INVESTMENT]

- Behavioral Health Continuum Infrastructure Program— Delays the last round of behavioral health continuum capacity funding of $480.7 million General Fund appropriated in the 2022 Budget Act for 2022-23 to $240.4 million in 2024-25 and $240.3 million in 2025-26. A total of $1.2 billion has been awarded to date, and the Budget maintains $480 million General Fund for crisis and behavioral health continuum grant funding to be awarded in 2022-23. [DELAYED]

- Department of Social Services

- State Supplementary Payment Increase— A $292 million allocated for an additional SSP increase of approximately 8.6 percent, effective January 1, 2024. The Budget maintains over $1 billion General Fund annually to provide increased cash assistance to individuals with disabilities and older adults in the Supplemental Security Income/State Supplementary Payment program, and low-income children and families in the CalWORKs program. [INVESTMENT]

- Cost-of-Living Adjustment (COLA)— $301.7 million General Fund for Child Care and Development Programs and $1.5 million for the Child and Adult Care Food Program to reflect an estimated statutory COLA of 8.13 percent. [INVESTMENT]

- Behavioral Health

- Behavioral Health Continuum— $8 billion total funds across various Health and Human Services departments to expand the continuum of behavioral health treatment and infrastructure capacity and transform the system for providing behavioral health services to children and youth. [INVESTMENT]

- Healthcare Workforce— Maintains over $1 billion General Fund to the Department of Health Care Access and Information (HCAI) to strengthen and expand the state’s health and human services workforce. These investments include funding for increasing nurses, community health workers and social workers, and supporting new individuals coming into the workforce in behavioral health, primary care and reproductive health. [INVESTMENT]

- Department of Healthcare Services

-

-

Community Strengthening

-

-

-

- CalWORKs Grant Increase— A 2.9 percent increase to CalWORKs Maximum Aid Payment levels, with an estimated cost of $87 million in 2023-24. [INVESTMENT]

- Child Care

- Child Care Availability and Affordability—The Budget sustains over $2 billion annualized to expand subsidized child care slot availability. [INVESTMENT]

- Child Care Slot Expansion Timing— To accommodate the time necessary to utilize recent slot expansions, the Budget assumes that 20,000 new slots that would have been funded in 2023-24 will instead be funded in 2024-25. [DELAYED]

- Preschool Inclusion Grants—The Budget delays for two years, from 2022-23 to 2024-25, the implementation of an annual $10 million General Fund grant program to support preschool inclusion efforts such as facility modifications or staff training. The Budget maintains the grant program on an ongoing basis beginning in 2024-25. [DELAYED]

- Food Resources

- California Food Assistance Program (CFAP) Expansion Timing—The Budget reflects updated timing of the CFAP expansion to all income-eligible noncitizens 55 years of age or older, consistent with the necessary completion of the California Statewide Automated Welfare System migration. Benefit distribution is estimated to begin January 1, 2027. [DELAYED]

-

-

Housing & Homelessness

Due to declining General Fund revenues, the Budget includes $350 million in reductions related to housing programs that were included as part of the 2022 Budget Act. Even with these reductions, funding for these housing programs remains at approximately 88 percent of the allocations made in 2022-23 and proposed for 2023-24 ($2.85 billion). If there is sufficient General Fund in January 2024, these reductions will be restored. See the Introduction Chapter for further information on this trigger.

-

-

-

- Housing

- Dream For All—The 2022 Budget Act included $500 million one-time General Fund to the California Housing Finance Agency for the Dream for All program, to provide shared-appreciation loans to help low- and moderate-income first-time homebuyers achieve homeownership. The Budget proposes to revert $200 million of the $500 million one-time General Fund in 2023-24. This proposal will not impact the Administration’s commitment or timeline for implementing the program. [REDUCTION]

- CalHome—The 2022 Budget Act included $350 million one-time General Fund ($250 million in the 2022 Budget Act and $100 million committed for 2023-24) for the Department of Housing and Community Development’s CalHome program, to provide local agencies and nonprofits grants to assist low- and very-low-income first-time homebuyers with housing assistance, counseling and technical assistance. The Budget proposes to remove $100 million one-time General Fund in 2023-24. [REDUCTION]

- Accessory Dwelling Unit Program—The 2022 Budget Act included $50 million one-time General Fund for the California Housing Finance Agency’s Accessory Dwelling Unit program. The Budget proposes to revert $50 million one-time General Fund in 2022-23. [REDUCTION]

- Behavioral Health Bridge Housing Program— Delays $250 million General Fund of the total $1.5 billion General Fund to 2024-25 for the Behavioral Health Bridge Housing Program. The Budget maintains $1 billion General Fund in 2022-23 and $250 million General Fund in 2023-24 for this program. [DELAYED]

- Homelessness

- The Budget includes $3.4 billion General Fund in 2023-24 to maintain the state’s efforts to address homelessness, as committed to in prior budgets. This includes $400 million for a third round of encampment resolution grants and $1 billion for a fifth round of HHAP grants, conditional on proposed statutory changes requiring greater accountability in the planning and expenditure of these critical homelessness resources. The Budget also includes funding to allow up to six months of rent or temporary housing to eligible individuals experiencing homelessness or at risk of homelessness and maintains funding for the Behavioral Health Bridge Housing Program (for more information, see the Health and Human Services Chapter). [INVESTMENT]

- Housing

-

-

Gas Price Gouging Penalty

In a special session in December of 2022, the Governor’s Administration, working with the Legislature, introduced a policy proposal: a price gouging penalty on excess oil refiner profits as well as transparency and oversight measures to help prevent future price gouging in California. While this proposal will be developed outside of the budget process, it is an important tool to prevent gas price hikes in the state by making it unlawful for refineries to collect excessive profits. The amount of the maximum margin and the amount of the penalty will be determined through the legislative process. Although the goal of the price gouging penalty is to discourage price hikes from hitting Californians in the first place, any funds collected by the penalty will go to a Price Gouging Penalty Fund and then go back to Californians.

Broadband Implementation

The 2021-22 and 2022-23 budgets made investments to expand access to broadband and close the digital divide across the state. While the 2023-24 Governor’s Budget proposal maintains the same level of funding for broadband middle-mile, last-mile, and the Loan Loss Reserve Fund (to support costs related to the financing of local broadband infrastructure development), $550 million designated to the California Public Utilities Commission (CPUC) for last-mile infrastructure grants in 2023-24 has been deferred ($200 million in 2024-25, $200 million in 2025-26, and $150 million in 2026-27). The Governor’s Budget proposal also defers $175 million from 2022-23 and $400 million from 2023-24 for the Loan Loss Reserve Fund at the CPUC to future years ($300 million in 2024-25 and $275 million in 2025-26). [DELAYED]